Table of Contents

ToggleIdentity verification is a core requirement across industries, especially during background verification (BGV) processes. Whether hiring a new employee, onboarding a gig worker, or enrolling users into secure services, verifying national identity documents is the first step toward building trust and compliance. One technology that has significantly streamlined this step is Optical Character Recognition (OCR).

OCR in BGV has emerged as a game-changing solution, enabling fast, accurate, and scalable ID data extraction. This blog explores how OCR simplifies national ID verification, its benefits across the BGV process, and its growing relevance in sectors like HR, fintech, edtech, and government services.

What is OCR?

Optical Character Recognition (OCR) is a technology that converts printed or handwritten text from images, scanned documents, or PDFs into machine-readable data. It detects characters, numbers, and symbols using AI and image processing algorithms, transforming static documents into structured, actionable data.

OCR is commonly used in automating manual data entry tasks. However, its application in background verification workflows has grown significantly in recent years.

Why National ID Verification Matters in BGV

Identity verification is central to background verification. Employers, service providers, and institutions must confirm the authenticity of individuals through government-issued IDs like Aadhaar, PAN, Voter ID, Driving License, and Passport. These IDs help establish core identity attributes such as name, date of birth, address, and photo.

Manually processing these documents is not only time-consuming but also prone to errors. With thousands of applications coming in daily—especially in sectors like gig work, delivery services, or mass recruitment—organizations need faster, scalable, and more accurate solutions. That’s where OCR in BGV plays a vital role.

How OCR Simplifies National ID Verification in BGV

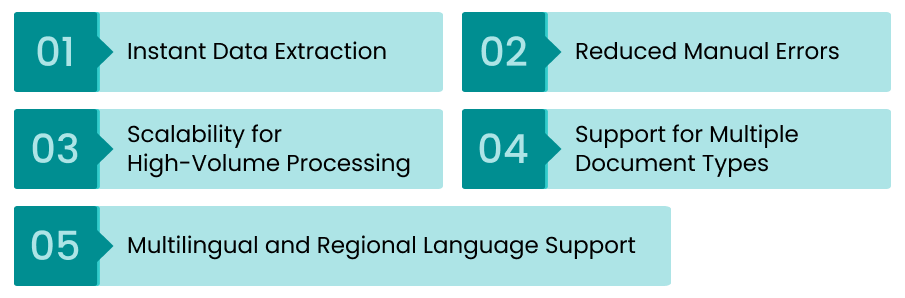

1. Instant Data Extraction

OCR automates the extraction of key fields such as full name, document number, DOB, and address from ID documents. Instead of manually typing in these details, OCR reads the document image and populates the data fields within seconds.

This accelerates BGV workflows—especially during onboarding—allowing companies to verify candidate identity with speed and consistency.

2. Reduced Manual Errors

Human data entry is prone to mistakes, especially when dealing with different formats, languages, and handwriting styles. OCR significantly reduces such errors by relying on trained AI models to accurately interpret text from structured and semi-structured documents.

3. Scalability for High-Volume Processing

With OCR, background verification firms and HR departments can process thousands of IDs per day without compromising on quality or accuracy. This is especially useful in large-scale hiring scenarios, such as seasonal staffing or nationwide recruitment drives.

4. Support for Multiple Document Types

Modern OCR engines support a wide variety of Indian identity documents—Aadhaar, PAN, Passport, Driving License, and more. Advanced systems can also identify and classify the document type automatically before extracting the data.

5. Multilingual and Regional Language Support

India’s diversity presents challenges in processing regional-language documents. OCR engines trained on Indian language datasets can read IDs written in Hindi, Bengali, Tamil, and other regional scripts—ensuring no one is excluded during verification.

Real-World Applications of OCR in BGV

1. Employment Background Checks

OCR is widely used by HR departments and background verification agencies to automate candidate ID verification.

2. Gig Economy and Field Workforce

Gig workers often join and leave platforms frequently. OCR helps onboard them instantly by scanning and verifying their national IDs in real time—speeding up the BGV cycle while keeping fraud risks low.

3. Financial Services & Lending

Lending platforms require both identity verification and background screening. OCR allows them to quickly validate the applicant’s identity and extract verified data needed for credit profiling or AML checks.

4. Education & Remote Learning

Edtech platforms use OCR to validate student or tutor identity, especially in competitive exam portals or virtual learning spaces where credential fraud is a concern.

Enhanced OCR with AI: A Smarter Approach to BGV

While traditional OCR handles text extraction, AI-powered OCR systems take it a step further. By combining OCR with machine learning and computer vision, organizations can:

Clean and enhance poor-quality images

Detect tampered or forged documents

Auto-classify document types

Validate extracted data in real time

Flag inconsistencies for manual review

This integration of AI ensures higher accuracy, reduced operational load, and enhanced fraud detection capabilities within the BGV pipeline.

Benefits of Using OCR in BGV

Here’s a quick summary of the key benefits:

- Speed: ID data is extracted in seconds, not minutes

- Accuracy: Minimizes human errors and inconsistencies

- Scalability: Easily handles high document volumes

- Cost-Effective: Reduces operational effort and costs

- Compliance-Friendly: Supports data protection frameworks

- Enhanced UX: Offers faster and frictionless onboarding

The Road Ahead

The adoption of OCR in BGV is only expected to grow as organizations seek faster and smarter ways to verify identity. With the rise of digital hiring, remote work, and real-time services, background verification processes must evolve to meet new demands.

As OCR continues to improve with advancements in AI, computer vision, and edge computing, its role in simplifying national ID verification and enabling secure, scalable BGV processes will only become more central.

FAQ’s

1. What is OCR and how does it work in background verification?

OCR (Optical Character Recognition) is a technology that reads and extracts text from scanned documents or images. In BGV, it automates the extraction of data from ID documents like Aadhaar or PAN, speeding up identity verification.

2. How accurate is OCR when reading ID documents?

Modern OCR systems, especially those enhanced with AI, offer high accuracy—even with low-quality images or regional scripts. Accuracy improves further when combined with image enhancement and validation layers.

3. Is OCR faster than manual data entry?

Yes, significantly. OCR extracts data in a few seconds, while manual entry can take minutes per document and is more prone to human error.

4. How does OCR improve the onboarding process?

OCR enables instant identity verification by extracting data from IDs in real time. This reduces friction, speeds up processing, and creates a smoother onboarding experience for users and employers.

5. Is OCR useful for bulk or high-volume verification tasks?

Absolutely. OCR is ideal for high-volume BGV scenarios such as mass hiring, gig worker onboarding, or seasonal recruitment, where scalability is key.

Leave a Reply