Table of Contents

ToggleThe issue of insurance fraud has reached alarming levels in India, posing significant challenges for insurance firms and policyholders alike. With billions of rupees lost annually due to fraudulent claims, the problem has escalated in recent years, making it increasingly difficult for honest consumers to access insurance coverage. This in-depth exploration aims to shed light on the multifaceted nature of insurance fraud in India, encompassing its various types, prevention strategies, and legal ramifications.

What is insurance fraud?

Insurance fraud in India refers to deceptive practices where individuals or groups attempt to illicitly gain from insurance policies by providing false or exaggerated information. This can include filing false claims, staging accidents, providing fake documents or records, identity theft, and other fraudulent activities.

Insurance fraud not only has an impact on insurance companies but also honest policyholders through increased premiums and reduced trust in the system. With billions of rupees lost annually due to fraudulent claims, the issue has become a significant challenge for the insurance industry in India.

To combat insurance fraud, various measures such as stringent verification processes, awareness campaigns, and technological advancements are being implemented.

Surge of Insurance Frauds In India

Recent reports have uncovered alarming trends in insurance fraud in India. According to the Times of India, fraudulent claims make up approximately 15% of all insurance claims, amounting to around 900 crores annually. Similarly, a survey by Deloitte India estimates that insurers lose close to 10% of their overall premium collections, translating to USD 6 billion annually, due to fraudulent activities.

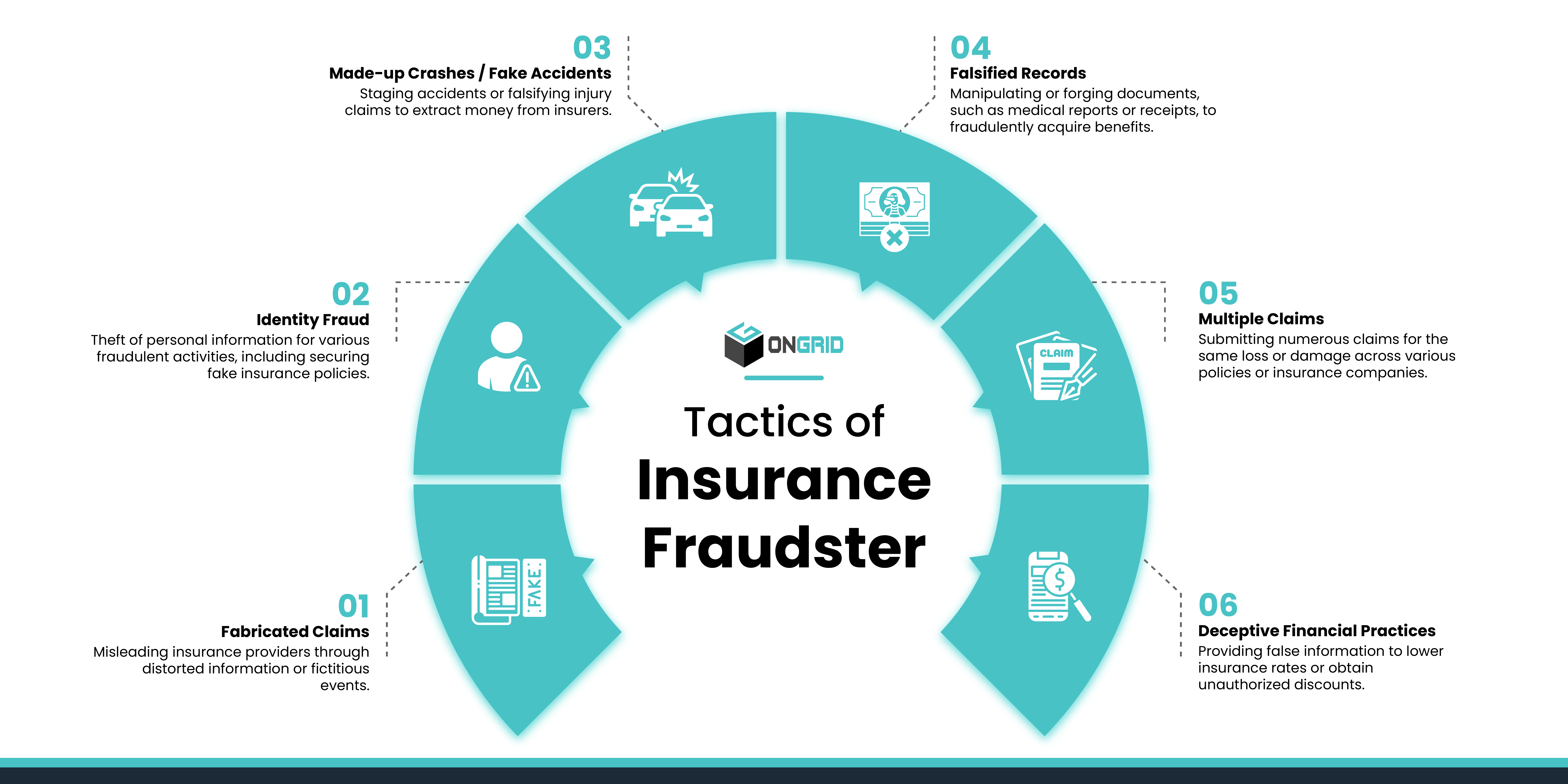

Exploring the Tactics of Insurance Fraudsters

Insurance fraudsters employ various tactics to deceive insurance providers and illicitly gain from insurance claims. These tactics include filing fake claims, staging accidents, providing false records or documents, and engaging in identity theft. By exploiting loopholes in the insurance system, fraudsters aim to pay out to which they are not entitled, ultimately causing financial losses to insurance companies and honest policy holders.

- Fabricated Claims: Misleading insurance providers through distorted information or fictitious events.

- Identity Fraud: Theft of personal information for various fraudulent activities, including securing fake insurance policies.

Read more: What is Identity Check & How is it Done? - Made-up Crashes / Fake Accidents: Staging accidents or falsifying injury claims to extract money from insurers.

- Falsified Records: Manipulating or forging documents, such as medical reports or receipts, to fraudulently acquire benefits.

- Multiple Claims: Submitting numerous claims for the same loss or damage across various policies or insurance companies.

- Deceptive Financial Practices: Providing false information to lower insurance rates or obtain unauthorised discounts.

Prevention Strategies

Preventing insurance fraud necessitates a collaborative approach involving insurance companies, regulators, and policyholders. Strategies include promoting awareness about fraud, strengthening regulatory measures, and implementing advanced technologies like AI and blockchain for fraud detection. By working together, stakeholders can mitigate the impact of fraud and maintain the integrity of the insurance system.

Raising Awareness: Educating policyholders about the consequences of fraud and promoting honesty and integrity.

Digitised claim process: Digitising claims involves leveraging technologies like artificial intelligence (AI) and intelligent automation. By implementing digital processes, insurers can detect fraud more effectively while providing genuine customers with a faster and more efficient claims processing experience.

Access criminal records quickly: To effectively prevent insurance fraud, insurers must have quick and easy access to external records, such as public records, social media profiles, and previous claims across the industry. These records provide valuable insights into claimants’ behaviour, history, and potential fraud indicators.

Swift On-Site Inspections: Visual evidence plays a pivotal role in motor insurance claims. Conducting prompt physical visits significantly reduces the likelihood of fraudulent claims. Vital evidence such as geo-coordinates and accident images obtained during these visits are instrumental in verifying the authenticity of claims.

Strengthening Regulations: Enforcing strict guidelines, penalties, and robust reporting mechanisms for fraudulent activities.

Training for insurance professionals: Providing comprehensive training to insurance professionals on identifying fraud indicators enhances their ability to detect and prevent fraudulent activities. Regular workshops, seminars, and online courses update them on the latest fraud schemes and prevention strategies.

Future of Combating Insurance Fraud

Collaborative efforts between insurance companies, regulators, and technology providers will be crucial in staying ahead of fraudsters and ensuring the integrity of the insurance industry. BGV companies with their established infrastructure are pivotal in combating fraud, while governmental reforms are a must for strengthening the regulatory framework.

Partnership with BGV Solution Providers: Leveraging the expertise and technological capabilities of Background Verification (BGV) companies will play a significant role in streamlining insurance claim verification processes. Their established networks and technological prowess enhance fraud detection capabilities.

Policy and Regulatory Reforms: Regulatory bodies are anticipated to refine guidelines and enact policy changes to address evolving fraud threats. Strengthening compliance requirements will be pivotal in safeguarding the integrity of the insurance industry.

Cutting-Edge Technologies: The integration of AI, Blockchain, and Telematics presents promising opportunities for the detection and prevention of insurance fraud.

Role of Insurance Companies: Investments in technology, training, and collaboration with stakeholders will be crucial for insurance companies in combating fraud.

How OnGrid Can Help?

OnGrid offers comprehensive physical due diligence solutions, including:

Field Investigations: Thorough investigations to uncover fraudulent activities.

Physical KYC: Verifying identities to prevent identity fraud.

Configurable Data Fields: Streamlining address verification with customizable data fields.

Field Visits for Motor Insurance Claims: Ensuring the legitimacy of claims through on-site inspections.

As the spectre of insurance fraud looms large over India’s insurance landscape, it becomes imperative to adopt proactive measures and innovative solutions to combat this pervasive issue. By dissecting the various types of fraud and understanding the tactics employed by fraudsters, we gain valuable insights into the challenges at hand.

Through a united effort involving heightened awareness, digitised processes, swift inspections, and strengthened regulations, we can fortify our defences against fraudulent activities.

Additionally, partnerships with Background Verification (BGV) solution providers and forthcoming policy reforms will further bolster our arsenal against fraudsters.

OnGrid stands at the forefront of this battle, offering comprehensive physical due diligence solutions to verify claims and safeguard the integrity of the insurance industry. By embracing innovation and collaboration, we can pave the way for a fair and trustworthy insurance ecosystem in India.

Ultimately, by remaining vigilant and proactive, we can stem the tide of insurance fraud and ensure a secure future for insurers and policyholders alike.

References:

1. https://bit.ly/3xx3YK5

2. https://bit.ly/43UIpiL

Leave a Reply