Table of Contents

ToggleIn the complex ecosystem of insurance, where risk mitigation and financial protection are paramount, insurance claim verification emerges as a critical process. Filing an insurance claim can be a stressful experience, especially after a major event like a fire, theft, or accident. But what happens when a claim isn’t quite what it seems? Insurance fraud is a significant problem, costing companies billions of dollars every year. That’s where Insurance Claim Verification comes in. This meticulous verification process not only safeguards the interests of insurance companies but also contributes to maintaining the integrity of the entire insurance industry.

Understanding Insurance Claim Verification

Insurance claim verification is the process of investigating and confirming the legitimacy of an insurance claim. It involves various steps to ensure the claim is accurate and reflects a genuine loss. Here are some common methods used:

Documentation review: Verifying receipts, police reports, medical records, and other documentation provided by the policyholder.

Data analysis: Cross-checking information against databases to identify inconsistencies or red flags.

Physical verification: In some cases, sending an investigator to the scene of the loss to assess the damage or interview witnesses.

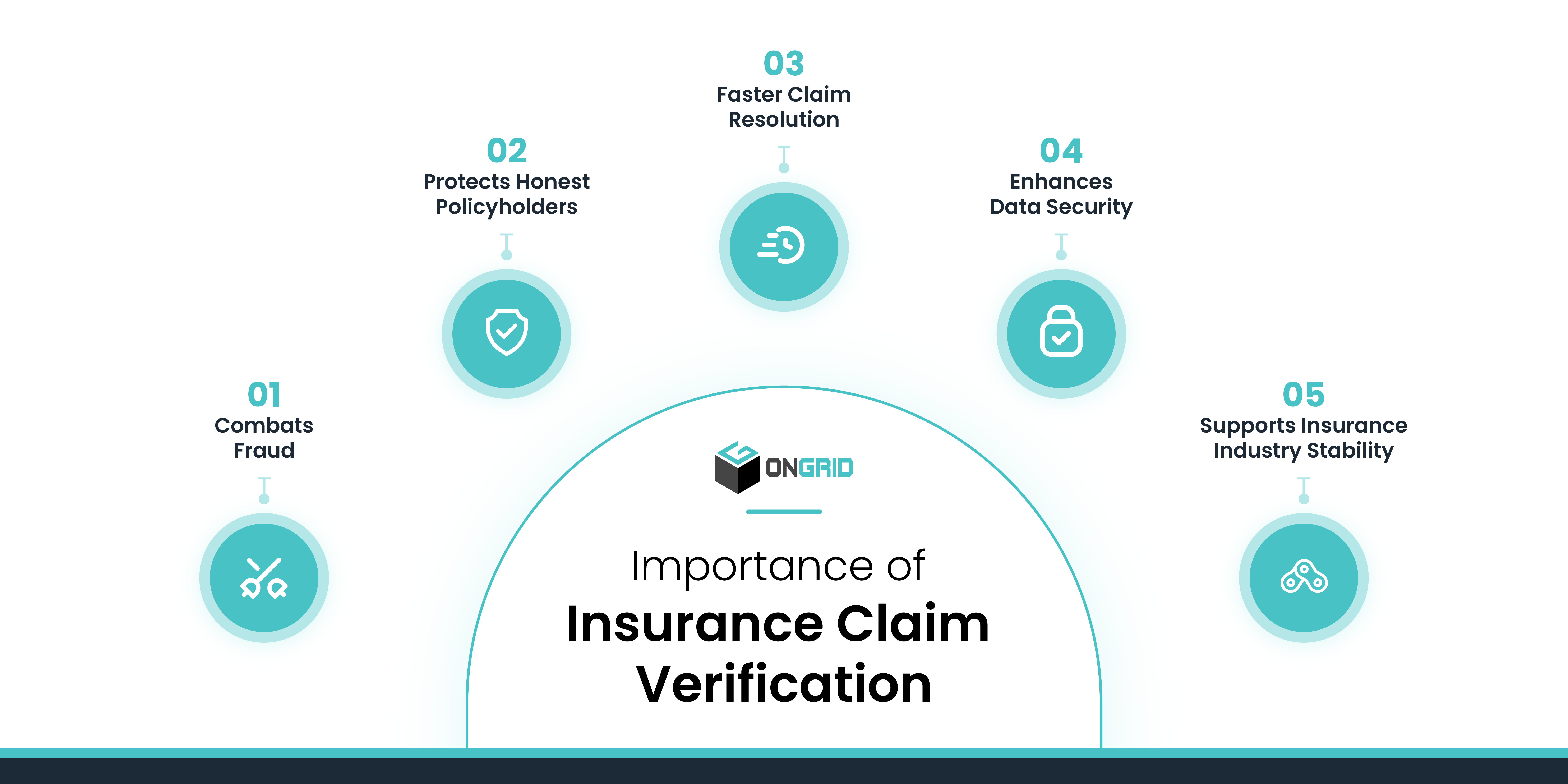

Importance of Insurance Claim Verification

There are several reasons why insurance claim verification is crucial:

Combats Fraud: Verification helps deter and uncover fraudulent claims, saving insurance companies from financial losses.

Protects Honest Policyholders: By weeding out fraudulent claims, verification helps maintain premiums at reasonable rates for all honest policyholders.

Faster Claim Resolution: When claims are verified quickly and efficiently, legitimate claims can be settled faster, minimizing stress for policyholders.

Enhances Data Security: Robust verification procedures safeguard sensitive policyholder information, protecting against data breaches and identity theft.

Supports Insurance Industry Stability: Effective verification contributes to the overall stability and sustainability of the insurance industry by minimizing the impact of fraudulent activities and ensuring fair and equitable treatment of policyholders.

What to Expect During the Verification Process

The specific steps of verification will vary depending on the type and complexity of the claim. However, you can generally expect the following:

Review of your claim details: This includes your policy coverage, the circumstances of the loss, and the details of your request.

Communication with you: The insurer may contact you for clarification or additional information.

Potential investigation: In some cases, an investigator may need to visit the scene of the loss or contact third parties.

Tips for a Smooth Verification Process

Be prepared: Gather all relevant documentation and receipts before filing your claim.

Be honest: Providing accurate and complete information from the start can expedite the verification process.

Cooperate with the investigator: Be responsive to any requests for information or clarification.

Ask questions: If you have any questions about the verification process, don’t hesitate to ask your insurance company.

Read Also: Physical Due Diligence: Comprehensive Risk Mitigation & Compliance

Challenges in Verification

Balancing Speed and Accuracy: A balance needs to be struck between verifying claims quickly and ensuring thorough investigations to avoid missing fraudulent activity.

Data Accuracy and Consistency: Inconsistent or incomplete information from policyholders or third parties can slow down the verification process.

Technological Limitations: Outdated systems and manual processes can make verification slow and cumbersome.

Despite these challenges, advancements in technology like data analytics and automation are helping streamline the verification process. Insurance companies are also working on improving communication with policyholders to ensure they understand the process and can provide accurate information.

How OnGrid Can Help?

These activities contribute to:

Risk Assessment Accuracy: Thorough profile verification ensures accurate risk evaluation, minimizing fraudulent claims and maintaining policy accuracy.

Operational Efficiency: Streamlined verification processes reduce turnaround time, costs, errors, and post-verification interventions, enhancing operational efficiency.

Customer Confidence: Robust verification instills trust through accurate risk assessment and prompt claim settlements, bolstering customer confidence.

Fraudulent Claims Prevention: Enhanced verification is crucial for secure insurance claims processing, particularly for death and health claims.

In conclusion, insurance claim verification serves as a cornerstone of the insurance industry, safeguarding against fraud, ensuring accuracy, and enhancing operational efficiency. By leveraging technology, embracing best practices, and maintaining a commitment to integrity, insurers can navigate the intricate landscape of claim verification with confidence. Ultimately, a robust verification process benefits both insurers and policyholders, fostering trust and resilience within the insurance ecosystem.

Leave a Reply