Table of Contents

ToggleMost employers view background verification (BGV) as a one-time exercise—something that happens at the time of hiring. But is a candidate’s background static? Not really. People change jobs, relocate, acquire new qualifications, and unfortunately, some may even engage in unethical or unlawful activities after being hired. This is why organizations need to rethink their approach and adopt continuous background checks.

The Importance of Continuous BGV

An employee’s background today may not be the same a year down the line. Various risks emerge over time, making it crucial for companies to stay updated. Here are some key reasons why continuous BGV is essential:

Criminal Activity: An employee might get involved in illegal activities while still working for you. Traditional one-time checks fail to capture this. According to NCRB data, India witnessed over 4.3 million cognizable crimes in 2023, emphasizing the need for regular re-verification.

Moonlighting & Dual Employment: With remote and hybrid work models, employees could be working for multiple organizations simultaneously, leading to conflicts of interest and productivity issues. A 2022 survey by Kotak Institutional Equities found that 65% of IT employees in India either engaged in or knew someone involved in moonlighting.

Address Changes: An updated address is crucial for legal compliance, logistics, and employee record accuracy. Studies show that nearly 30% of employees relocate every three years.

Regulatory & Compliance Needs: Industries such as BFSI, healthcare, and IT must meet strict compliance norms. Continuous checks help businesses stay audit-ready. A PwC report highlights that 67% of businesses globally faced compliance violations due to outdated employee verification data.

Safety & Reputation: A single oversight in hiring or retention could damage an organization’s reputation. Ensuring an ongoing vetting process minimizes such risks. According to a recent study, nearly 41% of employers reported fraudulent credentials in BGV reports.

Financial & Credit Risk Assessment: For finance and banking sectors, keeping an eye on employees’ financial health can prevent fraud and embezzlement. India saw a 35% increase in corporate fraud cases in the last five years, reinforcing the need for regular checks.

Employee Behavior & Productivity: Studies indicate that organizations with ongoing monitoring of employee behavior witness a 30% reduction in workplace misconduct and compliance violations.

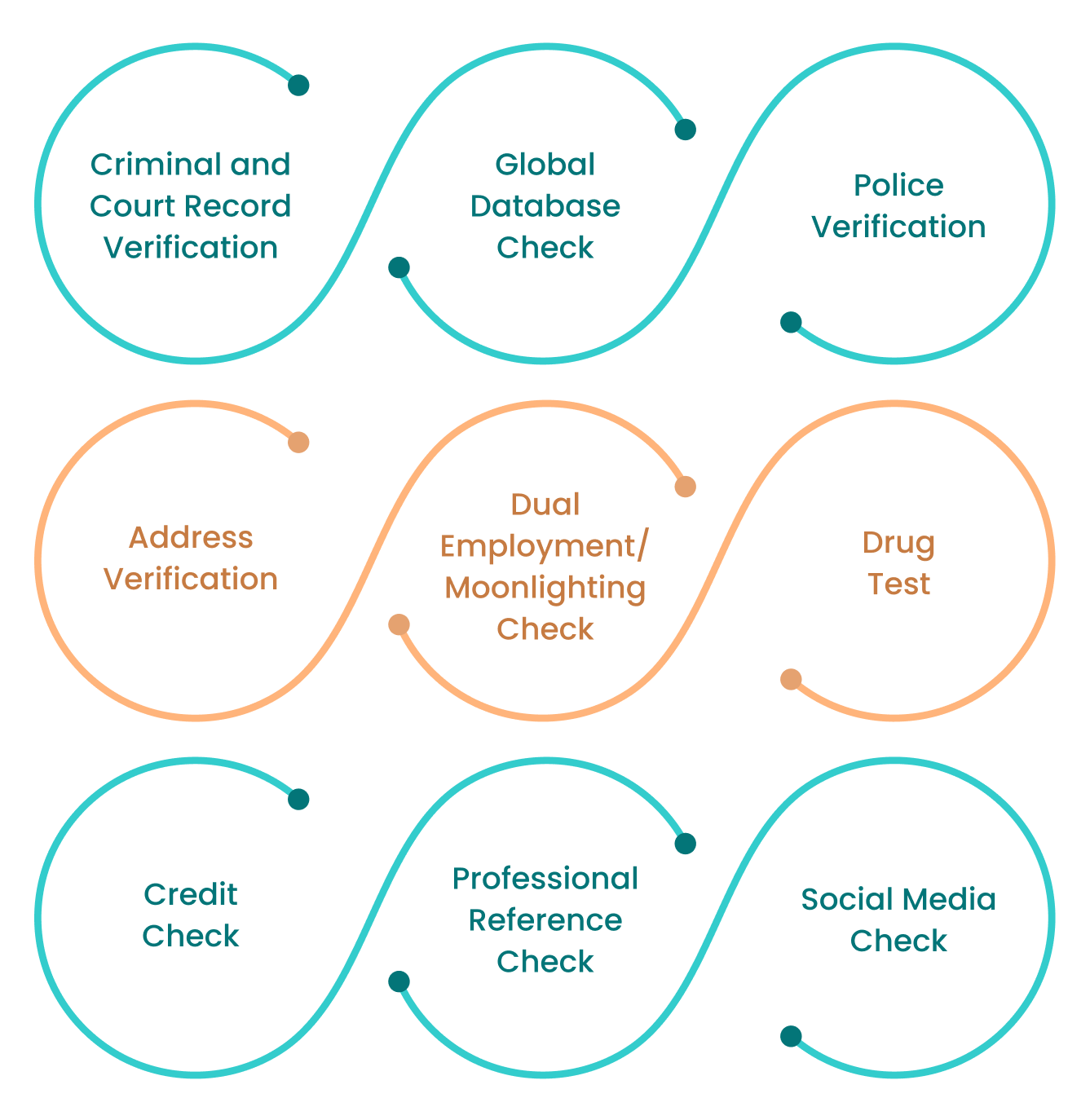

Key Checks for Continuous Background Verification

Not every check needs to be repeated frequently, but some should be conducted at regular intervals based on the organization’s risk profile. Here are a few essential periodic verifications.

Criminal and Court Record Verification – Detects any new criminal records or legal proceedings.

Global Database Check – Screens against global regulatory and compliance databases.

Police Verification – Ensures a more rigorous and official background verification process.

Address Verification – Confirms updated residential details, especially for remote employees.

Dual Employment/Moonlighting Check – Detects undisclosed employment engagements.

Drug Test– Ensures a safe and productive workplace. Research indicates that nearly 22% of Indian employees have reported drug use concerns in the workplace.

Credit Check – Crucial for employees handling sensitive financial data.

Professional Reference Check – Ensures employees maintain the required qualifications for their roles.

Social Media Check – Helps identify red flags related to employee social media behavior that could impact brand reputation.

Organizations must decide on the frequency of these checks—quarterly, biannually, or annually—based on their industry and internal policies

How OnGrid Makes Continuous BGV Seamless

OnGrid, India’s leading background verification platform, empowers organizations to conduct periodic BGV with efficiency and precision. Our technology-driven approach ensures:

Automated & AI-Driven Checks – Seamless re-verification without disrupting employee workflows.

Customizable BGV Programs – Tailor-made solutions based on industry-specific compliance needs.

150+ Verification Options – Covering everything from criminal records to employment history and digital identity verification.

Real-Time Monitoring – Instant updates and alerts on any flagged records.

Secure & Compliant Processes – Adhering to the highest data protection standards.

API-Driven Background Verification – Enabling seamless integration with HR and compliance systems.

Scalable BGV Solutions – Designed to handle high volumes of employee verifications with minimal manual intervention.

The Future of Background Verification

With workplaces evolving rapidly, organizations can no longer afford to rely on outdated hiring-era checks. Continuous background verification ensures an organization is always prepared, secure, and compliant. It mitigates risks, protects stakeholders, and helps companies uphold integrity within their workforce.

A Gartner report predicts that by 2026, at least 60% of large organizations will adopt continuous background verification for high-risk job roles. Proactive organizations are already shifting towards continuous BGV to create safer work environments and comply with evolving regulations.

Furthermore, regulatory changes across industries are emphasizing the importance of periodic employee screening. The Reserve Bank of India (RBI) and SEBI have introduced guidelines mandating stricter employee due diligence in financial institutions. Similarly, global regulations like the General Data Protection Regulation (GDPR) and Anti-Money Laundering (AML) directives stress the importance of ongoing employee monitoring.

Don’t wait for a compliance issue or reputational damage to act.

If you want to future-proof your workforce with seamless, tech-driven continuous BGV, connect with OnGrid at partner@ongrid.in or book a demo today!

Leave a Reply