The Union Budget is more than an annual financial statement—it’s a blueprint for India’s economic future. The 2025-26 budget places strong emphasis on infrastructure growth, digital expansion, MSME support, skill development, and data security, all of which have significant implications for businesses, BFSI institutions, and workforce recruitment.

Beyond fiscal policies and sectoral allocations, the budget highlights the need for a structured, secure, and trustworthy business environment where digital transactions, hiring decisions, and financial engagements are built on verified trust.

For this journey of development:

Four powerful engines: Agriculture, MSME, Investment, and Exports

Fuel: Reforms

Guiding spirit: Inclusivity

Destination: Viksit Bharat

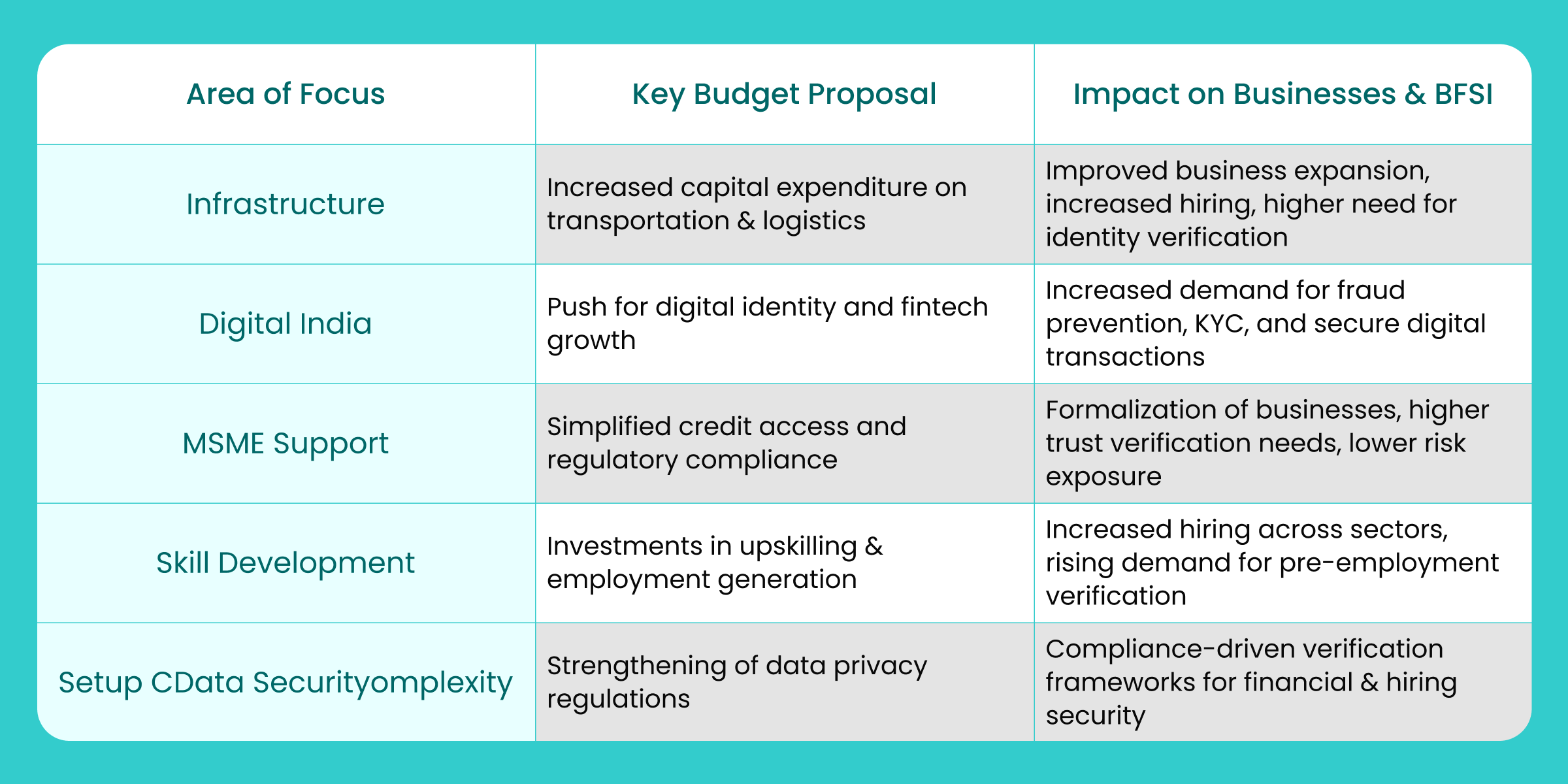

Key Budget Takeaways and Their Impact on Businesses

The 2025-26 Union Budget introduces several proposals designed to support India’s economic and digital growth while fostering a more secure and trustworthy business environment. Below are some of the core areas of focus and their direct impact on businesses and BFSI institutions.

1. Infrastructure Push: Enabling Business Expansion and Workforce Growth

The government’s continued focus on infrastructure development—including transportation networks, smart cities, logistics, and digital connectivity—lays the foundation for a thriving business ecosystem.

- Improved Logistics and Connectivity: Enhanced infrastructure will allow businesses to expand seamlessly across geographies, increasing hiring opportunities.

- Job Creation: Infrastructure investments lead to job creation, reinforcing the need for reliable workforce verification to maintain security and compliance in hiring.

- Robust Risk Assessment: With India strengthening its urban and rural connectivity, businesses will need a robust risk assessment framework to verify supply chain vendors, partners, and service providers.

- Increased Credit Demand: For BFSI companies and lending institutions, the economic boost from infrastructure projects will lead to increased credit demand, making KYC, fraud prevention, and financial background verification more crucial than ever.

2. Digital India & Data Protection: The Growing Importance of Secure Transactions

With the budget doubling down on Digital India, India’s economy is moving towards a tech-first approach where identity security, fraud prevention, and data privacy are no longer optional—they’re essential.

- Rise of Fintech: The growth of fintech, digital lending, and online transactions necessitates stronger fraud detection and identity authentication mechanisms.

- Digital Hiring: As companies embrace digital hiring and remote work, digital verification solutions will play a pivotal role in seamless employee onboarding.

- Cybersecurity and Data Privacy: Increased focus on cybersecurity and data privacy means organizations will need to ensure compliance with India’s evolving data protection laws, especially for industries handling sensitive customer information.

- Regulatory Compliance: For BFSI companies, data security and identity verification will be crucial in preventing fraud, mitigating risks, and ensuring regulatory compliance in financial transactions.

3. MSME Growth & Financial Inclusion: Enabling Small Businesses with Trust and Security

The budget extends financial and policy support to Micro, Small, and Medium Enterprises (MSMEs)—India’s backbone—by simplifying compliance norms and enhancing credit access.

- Formalization of Businesses: Increased government backing will formalize more businesses, leading to higher demand for workforce background verification to ensure safe hiring.

- Expansion of MSME Lending: The expansion of MSME lending requires fraud prevention mechanisms to assess creditworthiness and prevent financial risks.

- Digital Scaling: As MSMEs scale digitally, their reliance on digital KYC and identity verification solutions will grow to prevent fraud and ensure business credibility.

- Trust-Building: Trust-building will be key in India’s growing MSME sector, and ensuring transparency in workforce and financial dealings will enable businesses to thrive in a competitive market.

Read Also: How Technology is Revolutionizing Underwriting in SME Lending

4. Skill Development & Job Creation: Building a Verified, Trustworthy Workforce

A nation’s economy is only as strong as its workforce, and the budget’s focus on skilling, reskilling, and employment generation is a positive step toward India’s growth story.

- Government-Led Skill Development Programs: These programs will bring more professionals into the workforce, increasing the demand for pre-employment verification to ensure authenticity in hiring.

- Sectoral Talent Surges: Sectors like manufacturing, logistics, BFSI, and IT will witness talent surges, making identity verification, criminal record checks, and professional reference verifications integral to risk-free hiring.

- Gig Economy and Contractual Hiring: The rise of gig economy workers and contractual hiring will require businesses to establish stronger compliance and background verification frameworks to mitigate risk.

- Skilled Workforce in BFSI: For BFSI companies, a skilled workforce will drive financial product adoption, increasing the need for secure identity checks in banking, lending, and insurance transactions.

5. Strengthening Data Privacy and Compliance Frameworks

The budget also signals continued emphasis on data protection laws and compliance frameworks, impacting BFSI institutions, HR professionals, and digital businesses.

- Upgrading Verification Processes: Companies handling sensitive personal or financial data will need to upgrade their verification processes to align with new compliance mandates.

- Secure Verification Methods: Industries engaging in credit risk assessment, fraud detection, and digital transactions will need secure and legally compliant verification methods.

- Global Compliance: As businesses navigate cross-border hiring and global expansion, they will require globally accepted identity verification solutions to meet international compliance norms.

The Road Ahead: Trust as the Cornerstone of Growth

The Indian Union Budget 2025-26 lays the groundwork for a secure, digital-first, and high-growth economy. As businesses, recruiters, and financial institutions navigate these changes, the ability to establish trust, verify identities, and mitigate risks will define success.

How Trust and Verification Will Shape India’s Economic Future:

- Workforce Expansion & Hiring → Reliable pre-employment verification will ensure businesses onboard the right talent.

- Digital Transformation & Financial Security → Stronger KYC and fraud prevention will safeguard fintech and banking transactions.

- MSME & Startup Growth → Seamless business verification will enhance credibility in lending and partnerships.

- Compliance & Data Protection → Businesses will need privacy-first verification solutions to meet legal mandates.

Building trust isn’t a one-time process—it’s an ongoing commitment. Whether in recruitment, finance, or digital interactions, organizations that prioritize verification and transparency will be the ones driving India’s next wave of growth.

Tax Reforms and Business Implications

Income Tax Relief

- New tax slabs provide major relief for middle-class individuals, with those earning up to ₹12.75 lakh exempt from tax.

- Simplified tax filing process to boost compliance and ease financial burdens on individuals and businesses.

TDS and TCS Rationalisation

- Increased TDS threshold for rental income from ₹2.4 lakh to ₹6 lakh annually.

- Senior citizens benefit with a higher tax deduction on interest income, now ₹1 lakh (up from ₹50,000).

Corporate Tax Initiatives

- Presumptive taxation for non-resident entities and extended start-up tax exemptions encourage foreign investment and entrepreneurship.

- Boosts for MSMEs with doubled credit guarantees and special schemes for women and marginalized communities.

Customs Duty Reforms

- Exemption on lifesaving drugs and EV manufacturing, supporting healthcare and clean energy industries.

- Duty reductions on key export products like seafood to enhance competitiveness.

Fiscal Consolidation and Budgetary Estimates

- The fiscal deficit for FY 2025-26 is targeted at 4.4% of GDP, ensuring fiscal discipline while supporting growth.

- Capital expenditure has been ramped up to ₹10.18 lakh crore, indicating a push towards infrastructure development.

Final Thoughts

The 2025-26 Union Budget sets the stage for a dynamic and secure business landscape, where growth and trust go hand in hand. As India accelerates its digital and economic transformation, organizations must align with these changes by adopting robust verification, compliance, and fraud prevention measures.

Trust is not just a value—it’s a necessity. The businesses that embrace it will thrive in the new era of India’s growth story.

Leave a Reply