Table of Contents

ToggleFinancial Fitness: Why It Matters

Building a secure and trustworthy team demands smarter tools than gut feelings and endless reference checks. One powerful asset in your arsenal? Credit history checks. As financial responsibility becomes a key indicator of reliability, credit reports provide valuable insights into a candidate’s financial behavior.

With India’s booming credit card market and growing financial inclusion, understanding a candidate’s credit history is increasingly crucial for employers. Let’s explore why credit history checks should be a must-have tool for every savvy employer.

What is Credit History? It’s a Financial Report Card

Credit history is a record of an individual’s financial behavior, including their management of credit cards, loans, and other debts. It begins when someone applies for a loan or credit card, with lenders sharing account activity details with credit bureaus like Equifax and CIBIL. These bureaus compile this information to create credit reports, which form the basis of credit scores.

Demystifying Credit Scores

Credit scores, ranging from 300 to 900, reflect an individual’s creditworthiness to lenders. Key components of credit history that influence credit scores include:

1. Payment History: Timely payments positively impact credit scores, demonstrating reliability in repaying debts.

2. Credit Utilization: Lower credit card balances relative to limits are preferable, indicating responsible credit usage.

3. Length of Credit History: Longer credit history suggests experience in managing credit responsibly, boosting credit scores.

4. Mix of Credit Types: Diverse credit accounts reflect varied credit management skills, positively influencing credit scores.

5. Recent Applications: Multiple credit inquiries within a short period may temporarily lower credit scores, signaling increased credit-seeking behavior.

Why Employers Check Credit History

Employers conduct credit checks to assess the financial responsibility and integrity of an individual. This helps safeguard their organizations from financial risks and fraud, especially in roles involving financial transactions. These checks typically verify credit card debts, payment history, and personal information.

Employer Best Practices for Credit Checks

1. Exercise Caution: Ensure the use of validated credit scores from reputable credit bureaus and follow regulatory guidelines.

2. Fulfill Employer Obligations: Obtain employee consent and provide explanations for any negative decisions based on credit reports.

3. Ensure Candidate Privacy: It’s crucial to comply with strict regulations, such as India’s Credit Information Companies (Regulation) Act, and other relevant laws in respective countries to ensure the privacy and fair treatment of credit data.

4. Establish Adverse Action Procedures: Issue pre-adverse action notices and allow sufficient time for employees to respond before taking any adverse actions.

5. Make Educated Choices: Utilize credit checks judiciously to evaluate financial stability while respecting privacy rights and maintaining fairness towards employees.

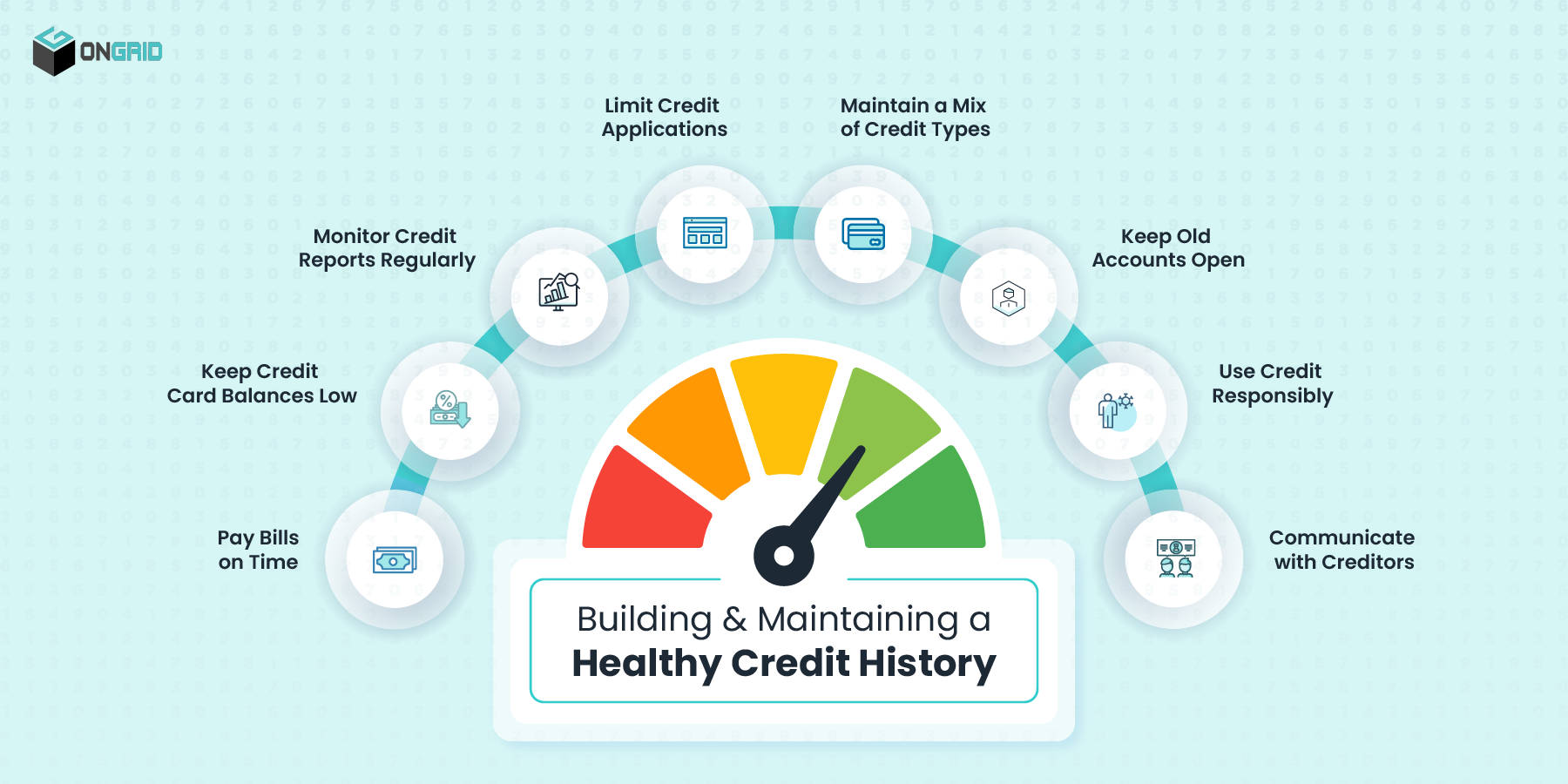

Building and Maintaining a Healthy Credit History

This section of our blog offers crucial guidance for individuals aiming to manage their finances effectively. It provides practical tips and strategies to establish and maintain a positive credit history, which is essential for accessing job and financial opportunities and ensuring long-term financial stability. Here are some key actions individuals can take to improve and maintain a positive credit history:

- Pay Bills on Time: Timely payment of bills, including credit card bills, loan instalments, and utility bills, is crucial for maintaining a positive credit history.

- Keep Credit Card Balances Low: Aim to keep credit card balances well below the credit limit to demonstrate responsible credit utilization.

- Monitor Credit Reports Regularly: Regularly check credit reports from major credit bureaus to identify errors or inaccuracies and address them promptly.

- Limit Credit Applications: Avoid applying for multiple credit cards or loans within a short period to prevent temporary dips in credit scores.

- Maintain a Mix of Credit Types: Maintain a diverse portfolio of credit accounts, including credit cards, loans, and mortgages, to demonstrate responsible credit management.

- Keep Old Accounts Open: Keeping older credit accounts open can help extend your credit history and improve credit scores, provided they are in good standing.

- Use Credit Responsibly: Practice responsible credit usage by avoiding overspending and only borrowing what you can afford to repay.

- Communicate with Creditors: In case of financial difficulties, communicate with creditors proactively to explore options for managing payments and avoiding negative marks on credit reports.

Conclusion: A win-win for everyone

Understanding credit checks empowers both organizations and individuals. Individuals can leverage a healthy credit history for better financial/job opportunities, while organizations can mitigate risk and maintain a trusted workforce. By following best practices and utilizing reliable credit history checks, we can all pave the way for a secure and prosperous future.

At OnGrid, we offer comprehensive solutions to simplify credit history check processes and ensure compliance. Partner with us to make informed decisions and safeguard your financial interests effectively.

Leave a Reply