Table of Contents

Toggle

Assessing creditworthiness is no longer limited to just reviewing credit scores or banking history. Lenders, especially in the fintech space, are now focusing on real-world data points to minimize fraud, enhance underwriting, and ensure responsible lending. One such critical element of modern lending infrastructure is Contact Point Verification (CPV).

Must read: Understanding Contact Point Verification: Importance and Use Cases

Why CPV Matters More Than Ever

Verifying a borrower’s contact details – particularly their physical address – has emerged as a vital risk management tool. This is especially true for unsecured loans and digital credit platforms where in-person interactions are minimal or non-existent.

Inaccurate, incomplete, or fabricated address information can derail loan recovery efforts, inflate default risks, and create regulatory compliance challenges. That’s where CPV comes in, acting as the bridge between digital applications and real-world verification.

Real-World Challenges CPV Solves

A leading digital payments and credit platform recently partnered with OnGrid to address precisely these concerns:

Inaccurate Address Inputs: Borrowers often provide vague or incorrect location details, complicating both communication and recovery.

Identity Verification Gaps: Without reliable address verification, it’s tough to confirm a borrower’s authenticity.

Fraud Exposure & Compliance Risks: Unverified data significantly heightens a lender’s exposure to financial crime and regulatory penalties.

OnGrid’s CPV: A Holistic Verification Solution

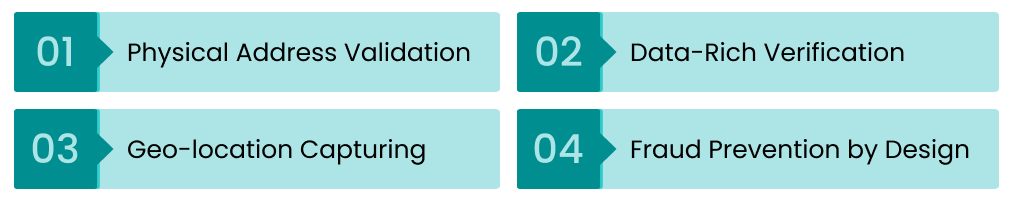

OnGrid tackled these issues with its robust CPV solution, built to validate borrower identities and addresses at scale. Here’s how:

1. Physical Address Validation

Field agents conducted door-to-door address verification, ensuring that every borrower’s location matched the one provided during application. They also recorded nearby landmarks to aid future field visits.

2. Data-Rich Verification

The process included checks on:

Identity documents

Ownership or rental status of premises

Type and size of locality

Inputs from neighbors for additional validation

3. Geo-location Capturing

To enhance authenticity, CPV also incorporated geo-tagging, verifying the borrower’s presence at the said address using GPS coordinates.

4. Fraud Prevention by Design

By capturing comprehensive contact data and triangulating it with other verification sources, OnGrid’s CPV helped curb fraudulent applications and minimized exposure to bad loans.

Business Impact: Beyond Just Verification

The outcomes of implementing CPV were clear and measurable for the lender:

Improved Loan Recovery: Better contact accuracy led to higher engagement and recovery rates.

Lower NPAs: Early detection of fake or incomplete addresses helped reduce defaults.

Enhanced Operational Efficiency: Automated data collection freed up operational bandwidth.

Regulatory Compliance: Verified borrower data aligned with KYC/AML mandates, ensuring audit readiness.

Conclusion: Trust, Built at the Point of Contact

In lending, trust starts with data. CPV is no longer a nice-to-have – it’s a must-have for lenders seeking to scale responsibly while protecting themselves from risk. OnGrid’s Contact Point Verification offers a proven framework for building that trust by connecting the dots between borrowers’ digital footprints and their real-world presence.

Whether you’re a fintech startup or an established NBFC, incorporating CPV into your onboarding and risk assessment workflows is a strategic investment – one that pays off in both performance and peace of mind.

Frequently Asked Questions (FAQs)

1. What is Contact Point Verification (CPV)?

CPV is the process of physically verifying a borrower’s address and contact details to ensure authenticity, typically done via field visits and geo-tagging.

2. Who benefits from CPV?

Lenders, NBFCs, fintech platforms, insurance providers, and other businesses that rely on accurate customer data for credit underwriting, compliance, or recovery benefit from CPV.

3. Is CPV only useful for personal loans?

Not at all. CPV is valuable across business and personal lending scenarios, especially for unsecured credit products where the lender has limited recourse.

4. How long does a CPV usually take?

Turnaround time can vary by location and case volume, but OnGrid’s field network and tech-powered platform enable quick and scalable verifications.

5. Can CPV be integrated into our existing workflows?

Yes, OnGrid’s CPV solution is API-first and can be seamlessly integrated with your current loan origination or risk management systems.

6. Does CPV help with fraud detection?

Absolutely. CPV serves as a frontline defense against fake identities and fraudulent applications by ensuring that the borrower actually resides at the claimed location.

7. What other checks can be combined with CPV?

CPV is often bundled with ID verification, bank account verification, criminal checks, and employment history checks for a more holistic risk profile.

Leave a Reply