Table of Contents

ToggleIn the dynamic world of business, where partnerships and collaborations serve as the lifeblood of growth and success, the importance of due diligence cannot be overstated. Picture this: You’re embarking on a journey to build something great, but before you take that crucial step forward, you need to ensure that your path is clear of obstacles and pitfalls. This is where due diligence steps in as your trusted guide, helping you navigate the complexities of business transactions with clarity and confidence.

What exactly is due diligence?

Due diligence is a comprehensive and systematic investigation or appraisal that an individual or business undertakes before entering into a contract or agreement with another party. It involves a thorough examination of relevant facts, information, and potential risks associated with the transaction. Due diligence is essentially a preventative measure that aims to identify any red flags, mitigate risks, and ensure informed decision-making.

Imagine diving into the ocean before checking the tides. Due diligence is like pulling out a trusty life jacket and mapping the currents. It’s a comprehensive investigation into a vendor’s financial stability, operational efficiency, and ethical practices. You assess their capabilities, track record, and potential risks, ensuring they align with your needs and values.

Why is it important?

Conducting due diligence in business transactions is a multifaceted process aimed at obtaining a comprehensive understanding of a company’s financial health, enabling investors to make informed decisions on potential investments.

This exhaustive examination involves assessing the risks and contingent liabilities associated with the target company, identifying shortcomings, and scrutinizing unforeseen problems that can be rectified before entering into agreements.

Particularly crucial in mergers and acquisitions, due diligence safeguards against heightened risks for the acquiring party, as it involves a thorough evaluation of the terms, conditions, assets, liabilities, and overall profitability of the target business.

Essentially, due diligence serves as a strategic imperative, providing confidential insights that empower professionals to navigate negotiations, assess risks, and make intelligible decisions pivotal for successful business transactions.

Vendor Due Diligence – Elevating Security

Vendor due diligence is a crucial process for businesses seeking to assess and manage potential risks associated with their vendors, suppliers, or third-party partners. This comprehensive evaluation involves scrutinizing various aspects of the vendor, including financial stability, operational integrity, cybersecurity measures, and supplier considerations. The goal is to compile a detailed report that provides insights into the vendor’s overall profile, enabling effective vendor management.

The due diligence process typically includes a thorough review of contracts, assessments completed by the vendor, and the gathering of external intelligence. This meticulous approach ensures that businesses can swiftly onboard new vendors while maintaining a proactive stance on risk management. As businesses adapt to the dynamic nature of risks, comprehensive diligence processes remain a cornerstone for secure and efficient management of vendors.

Reasons to Conduct Vendor Due Diligence

Risk Minimization: A primary goal of vendor due diligence is to minimize risk. Through meticulous analysis of potential partners or assets slated for sale, companies can proactively identify and address potential pitfalls, uncertainties, and challenges that may arise during the course of the partnership. The emphasis on speed and efficiency in this process is vital to ensure a thorough examination of all aspects, leaving no room for overlooked concerns.

Legal Compliance: Ensuring legal compliance is another essential objective. It is imperative to verify that the target business operates within the boundaries of the law, adhering to all regulatory requirements. This not only helps in steering clear of potential legal implications but also establishes a foundation of trust and transparency between the involved parties.

Financial Stability Assessment: An integral aspect of diligence involves assessing the financial stability of a potential partner. By gaining insights into their financial performance, trends, and cash flows, businesses can gauge the long-term viability and profitability of the intended partnership. This financial scrutiny provides a clear picture of the economic health of the potential partner.

Operational Security: Evaluating operational security ensures that the business operations of the prospective partner align with the standards and expectations of the company conducting the diligence. This assessment helps identify and mitigate any unforeseen challenges that might impact the operational efficiency and security of the partnership.

Business Continuity and Resilience: It aims to secure business continuity and resilience. In a dynamic business landscape, partnering with entities capable of adapting, evolving, and thriving amidst challenges is crucial. This strategic approach ensures that the partnership remains robust, even in the face of unforeseen adversities.

Read also: Top 6 Background Screening Metrics You Should Know Before Hiring

In essence, vendor due diligence acts as a multi-pronged shield, safeguarding your business from various potential risks and ensuring informed decision-making when forging partnerships or acquiring assets. By minimizing inherent risks, verifying legal compliance, assessing financial stability, evaluating operational security, and securing business continuity, you equip yourself with the insights necessary to navigate the partnership with confidence and minimize potential pitfalls.

Remember, thorough due diligence isn’t just about identifying red flags; it’s about building a foundation of trust, transparency, and long-term success for your business ventures.

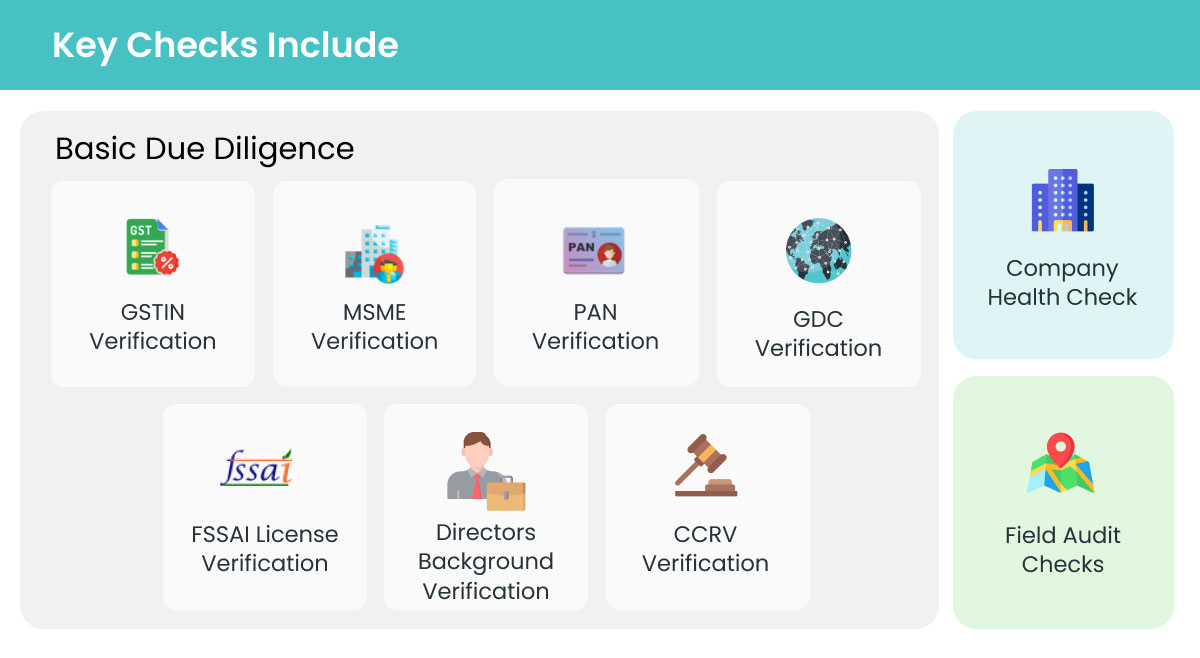

Vendor Due Diligence with OnGrid

OnGrid sets the standard for excellence in Vendor Due Diligence (VDD) services, offering comprehensive solutions tailored to meet your specific needs and requirements. Here’s why OnGrid stands out:

Affordable Solutions: Enjoy the advantage of cost-effective and competitive pricing that suits your budget, making our Vendor Due Diligence Services accessible and budget-friendly.

Rapid Turnaround Time: Experience superfast processing that delivers swift results, allowing you to make timely decisions and streamline your operations.

Comprehensive Reports: Access comprehensive and insightful reports that provide in-depth information, ensuring you have a clear understanding of your vendors, suppliers, and partners.

Precision and Accuracy: Rely on our commitment to precision and accuracy, ensuring meticulous examination and reliable outcomes for your vendor assessments.

Read: The Ultimate Guide to Streamlining Business Operations with GSTIN Verification API

In conclusion, due diligence stands as the bedrock of successful business transactions and partnerships, ensuring that decisions are rooted in comprehensive understanding and meticulous examination rather than blind optimism. By conducting thorough due diligence, individuals and organizations can uncover hidden risks, assess potential liabilities, and make informed choices that align with their objectives and values.

Whether in the context of mergers and acquisitions, vendor partnerships, or supplier evaluations, due diligence serves as a critical tool for risk management, legal compliance, and operational efficiency. It empowers stakeholders to navigate negotiations with confidence, mitigating uncertainties and safeguarding against potential pitfalls.

Leave a Reply